Predictive Insights Portfolio for 2117258, 4184250201, 6981867195, 120096531, 3435158807, and 917886818

The Predictive Insights Portfolio for identifiers 2117258, 4184250201, 6981867195, 120096531, 3435158807, and 917886818 employs sophisticated analytics to inform investment strategies. Each identifier holds distinct market relevance, influencing potential outcomes. By examining historical data and current market trends, investors can better anticipate shifts. This analytical approach not only enhances decision-making but also offers a framework for effective risk management. What specific insights can be gleaned from these identifiers that might reshape investment tactics?

Understanding Predictive Analytics in Finance

As financial markets become increasingly complex, understanding predictive analytics in finance has emerged as a crucial component for informed decision-making.

Predictive models enhance financial forecasting by enabling data-driven decisions, improving risk assessment, and optimizing algorithmic trading strategies.

Through trend analysis and performance metrics, investors can make accurate investment predictions, ultimately fostering greater autonomy and strategic insight in their financial endeavors.

Overview of the Identifiers and Their Significance

While understanding predictive analytics is vital, recognizing the identifiers used in these models is equally essential for maximizing their effectiveness.

Each identifier holds significance, influencing decision-making processes and providing insight into market dynamics. Their accurate interpretation can lead to strategic financial implications, enabling stakeholders to navigate complexities and capitalize on opportunities, ultimately enhancing performance and fostering informed decision-making in an ever-evolving landscape.

Analyzing Market Trends Using Historical Data

To effectively analyze market trends, historical data serves as a critical foundation, offering insights that reveal patterns and behaviors over time.

By examining historical correlations, analysts can identify market dynamics that inform future movements. This approach enables stakeholders to anticipate shifts and adapt strategies accordingly, promoting informed decision-making.

Understanding these trends fosters a sense of autonomy in navigating complex market landscapes.

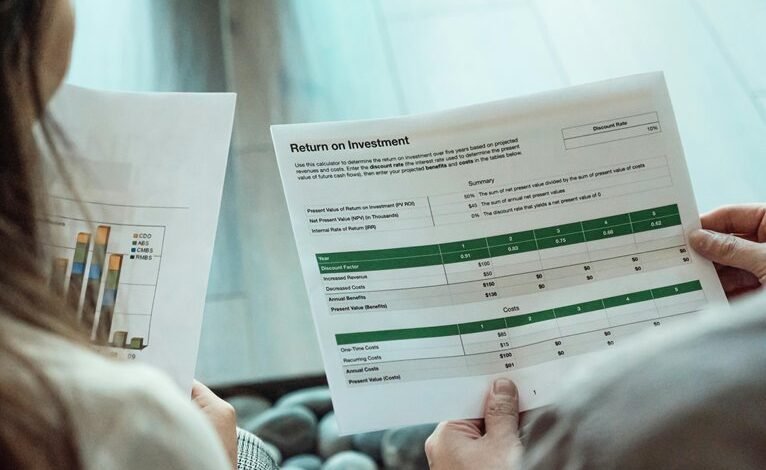

Enhancing Investment Strategies Through Predictive Insights

Incorporating predictive insights into investment strategies allows investors to leverage advanced analytics, enhancing their ability to make informed decisions.

By utilizing data visualization techniques, investors can better comprehend complex market dynamics and trends.

Additionally, robust risk assessment frameworks facilitate the identification of potential pitfalls, enabling a proactive approach to investment management.

This combination empowers investors to optimize performance while mitigating exposure to unforeseen risks.

Conclusion

In conclusion, the Predictive Insights Portfolio serves as a compass in the tumultuous sea of financial markets, guiding investors through the waves of uncertainty. By harnessing the power of advanced analytics and historical data, stakeholders can navigate complexities with greater confidence and foresight. As they leverage these insights, the potential for optimized investment strategies emerges, inviting a future where informed decisions illuminate the path to success amidst ever-evolving market dynamics.